ML Approaches for Identifying Credit Card Fraud#

Introduction

In this kernel we will use various predictive models to see how accurate they are in detecting whether a transaction is a normal payment or a fraud.Our Goals:

- Understand the little distribution of the "little" data that was provided to us.

- Create a 50/50 sub-dataframe ratio of "Fraud" and "Non-Fraud" transactions. (NearMiss Algorithm)

- Determine the Classifiers we are going to use and decide which one has a higher accuracy.

- Create a Neural Network and compare the accuracy to our best classifier.

- Understand common mistaked made with imbalanced datasets.

Outline:

I. Understanding our dataa) Gather Sense of our data

II. Preprocessing

a) Scaling and Distributing

b) Splitting the Data

III. Random UnderSampling and Oversampling

a) Distributing and Correlating

b) Anomaly Detection

c) Dimensionality Reduction and Clustering (t-SNE)

d) Classifiers

e) A Deeper Look into Logistic Regression

f) Oversampling with SMOTE

IV. Testing

a) Testing with Logistic Regression

b) Neural Networks Testing (Undersampling vs Oversampling)

Correcting Previous Mistakes from Imbalanced Datasets:

- Never test on the oversampled or undersampled dataset.

- If we want to implement cross validation, remember to oversample or undersample your training data during cross-validation, not before!

- Don't use accuracy score as a metric with imbalanced datasets (will be usually high and misleading), instead use f1-score, precision/recall score or confusion matrix

Gather Sense of Our Data:#

The first thing we must do is gather a basic sense of our data. Remember, except for the transaction and amount we dont know what the other columns are (due to privacy reasons). The only thing we know, is that those columns that are unknown have been scaled already.

Summary:

- The transaction amount is relatively small. The mean of all the mounts made is approximately USD 88.

- There are no "Null" values, so we don't have to work on ways to replace values.

- Most of the transactions were Non-Fraud (99.83%) of the time, while Fraud transactions occurs (017%) of the time in the dataframe.

Feature Technicalities:

- PCA Transformation: The description of the data says that all the features went through a PCA transformation (Dimensionality Reduction technique) (Except for time and amount).

- Scaling: Keep in mind that in order to implement a PCA transformation features need to be previously scaled. (In this case, all the V features have been scaled or at least that is what we are assuming the people that develop the dataset did.)

# Imported Libraries

import numpy as np # linear algebra

import pandas as pd # data processing, CSV file I/O (e.g. pd.read_csv)

import tensorflow as tf

import matplotlib.pyplot as plt

import seaborn as sns

from sklearn.manifold import TSNE

from sklearn.decomposition import PCA, TruncatedSVD

import matplotlib.patches as mpatches

import time

# Classifier Libraries

from sklearn.linear_model import LogisticRegression

from sklearn.svm import SVC

from sklearn.neighbors import KNeighborsClassifier

from sklearn.tree import DecisionTreeClassifier

from sklearn.ensemble import RandomForestClassifier

import collections

# Other Libraries

from sklearn.model_selection import train_test_split

from sklearn.pipeline import make_pipeline

from imblearn.pipeline import make_pipeline as imbalanced_make_pipeline

from imblearn.over_sampling import SMOTE

from imblearn.under_sampling import NearMiss

from imblearn.metrics import classification_report_imbalanced

from sklearn.metrics import precision_score, recall_score, f1_score, roc_auc_score, accuracy_score, classification_report

from collections import Counter

from sklearn.model_selection import KFold, StratifiedKFold

import warnings

warnings.filterwarnings("ignore")

df = pd.read_csv('../input/creditcard.csv')

df.head()

/opt/conda/lib/python3.6/site-packages/sklearn/externals/six.py:31: DeprecationWarning: The module is deprecated in version 0.21 and will be removed in version 0.23 since we've dropped support for Python 2.7. Please rely on the official version of six (https://pypi.org/project/six/).

"(https://pypi.org/project/six/).", DeprecationWarning)

| Time | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount | Class | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 0.0 | -1.359807 | -0.072781 | 2.536347 | 1.378155 | -0.338321 | 0.462388 | 0.239599 | 0.098698 | 0.363787 | 0.090794 | -0.551600 | -0.617801 | -0.991390 | -0.311169 | 1.468177 | -0.470401 | 0.207971 | 0.025791 | 0.403993 | 0.251412 | -0.018307 | 0.277838 | -0.110474 | 0.066928 | 0.128539 | -0.189115 | 0.133558 | -0.021053 | 149.62 | 0 |

| 1 | 0.0 | 1.191857 | 0.266151 | 0.166480 | 0.448154 | 0.060018 | -0.082361 | -0.078803 | 0.085102 | -0.255425 | -0.166974 | 1.612727 | 1.065235 | 0.489095 | -0.143772 | 0.635558 | 0.463917 | -0.114805 | -0.183361 | -0.145783 | -0.069083 | -0.225775 | -0.638672 | 0.101288 | -0.339846 | 0.167170 | 0.125895 | -0.008983 | 0.014724 | 2.69 | 0 |

| 2 | 1.0 | -1.358354 | -1.340163 | 1.773209 | 0.379780 | -0.503198 | 1.800499 | 0.791461 | 0.247676 | -1.514654 | 0.207643 | 0.624501 | 0.066084 | 0.717293 | -0.165946 | 2.345865 | -2.890083 | 1.109969 | -0.121359 | -2.261857 | 0.524980 | 0.247998 | 0.771679 | 0.909412 | -0.689281 | -0.327642 | -0.139097 | -0.055353 | -0.059752 | 378.66 | 0 |

| 3 | 1.0 | -0.966272 | -0.185226 | 1.792993 | -0.863291 | -0.010309 | 1.247203 | 0.237609 | 0.377436 | -1.387024 | -0.054952 | -0.226487 | 0.178228 | 0.507757 | -0.287924 | -0.631418 | -1.059647 | -0.684093 | 1.965775 | -1.232622 | -0.208038 | -0.108300 | 0.005274 | -0.190321 | -1.175575 | 0.647376 | -0.221929 | 0.062723 | 0.061458 | 123.50 | 0 |

| 4 | 2.0 | -1.158233 | 0.877737 | 1.548718 | 0.403034 | -0.407193 | 0.095921 | 0.592941 | -0.270533 | 0.817739 | 0.753074 | -0.822843 | 0.538196 | 1.345852 | -1.119670 | 0.175121 | -0.451449 | -0.237033 | -0.038195 | 0.803487 | 0.408542 | -0.009431 | 0.798278 | -0.137458 | 0.141267 | -0.206010 | 0.502292 | 0.219422 | 0.215153 | 69.99 | 0 |

df.describe()

| Time | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Amount | Class | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 284807.000000 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 2.848070e+05 | 284807.000000 | 284807.000000 |

| mean | 94813.859575 | 3.919560e-15 | 5.688174e-16 | -8.769071e-15 | 2.782312e-15 | -1.552563e-15 | 2.010663e-15 | -1.694249e-15 | -1.927028e-16 | -3.137024e-15 | 1.768627e-15 | 9.170318e-16 | -1.810658e-15 | 1.693438e-15 | 1.479045e-15 | 3.482336e-15 | 1.392007e-15 | -7.528491e-16 | 4.328772e-16 | 9.049732e-16 | 5.085503e-16 | 1.537294e-16 | 7.959909e-16 | 5.367590e-16 | 4.458112e-15 | 1.453003e-15 | 1.699104e-15 | -3.660161e-16 | -1.206049e-16 | 88.349619 | 0.001727 |

| std | 47488.145955 | 1.958696e+00 | 1.651309e+00 | 1.516255e+00 | 1.415869e+00 | 1.380247e+00 | 1.332271e+00 | 1.237094e+00 | 1.194353e+00 | 1.098632e+00 | 1.088850e+00 | 1.020713e+00 | 9.992014e-01 | 9.952742e-01 | 9.585956e-01 | 9.153160e-01 | 8.762529e-01 | 8.493371e-01 | 8.381762e-01 | 8.140405e-01 | 7.709250e-01 | 7.345240e-01 | 7.257016e-01 | 6.244603e-01 | 6.056471e-01 | 5.212781e-01 | 4.822270e-01 | 4.036325e-01 | 3.300833e-01 | 250.120109 | 0.041527 |

| min | 0.000000 | -5.640751e+01 | -7.271573e+01 | -4.832559e+01 | -5.683171e+00 | -1.137433e+02 | -2.616051e+01 | -4.355724e+01 | -7.321672e+01 | -1.343407e+01 | -2.458826e+01 | -4.797473e+00 | -1.868371e+01 | -5.791881e+00 | -1.921433e+01 | -4.498945e+00 | -1.412985e+01 | -2.516280e+01 | -9.498746e+00 | -7.213527e+00 | -5.449772e+01 | -3.483038e+01 | -1.093314e+01 | -4.480774e+01 | -2.836627e+00 | -1.029540e+01 | -2.604551e+00 | -2.256568e+01 | -1.543008e+01 | 0.000000 | 0.000000 |

| 25% | 54201.500000 | -9.203734e-01 | -5.985499e-01 | -8.903648e-01 | -8.486401e-01 | -6.915971e-01 | -7.682956e-01 | -5.540759e-01 | -2.086297e-01 | -6.430976e-01 | -5.354257e-01 | -7.624942e-01 | -4.055715e-01 | -6.485393e-01 | -4.255740e-01 | -5.828843e-01 | -4.680368e-01 | -4.837483e-01 | -4.988498e-01 | -4.562989e-01 | -2.117214e-01 | -2.283949e-01 | -5.423504e-01 | -1.618463e-01 | -3.545861e-01 | -3.171451e-01 | -3.269839e-01 | -7.083953e-02 | -5.295979e-02 | 5.600000 | 0.000000 |

| 50% | 84692.000000 | 1.810880e-02 | 6.548556e-02 | 1.798463e-01 | -1.984653e-02 | -5.433583e-02 | -2.741871e-01 | 4.010308e-02 | 2.235804e-02 | -5.142873e-02 | -9.291738e-02 | -3.275735e-02 | 1.400326e-01 | -1.356806e-02 | 5.060132e-02 | 4.807155e-02 | 6.641332e-02 | -6.567575e-02 | -3.636312e-03 | 3.734823e-03 | -6.248109e-02 | -2.945017e-02 | 6.781943e-03 | -1.119293e-02 | 4.097606e-02 | 1.659350e-02 | -5.213911e-02 | 1.342146e-03 | 1.124383e-02 | 22.000000 | 0.000000 |

| 75% | 139320.500000 | 1.315642e+00 | 8.037239e-01 | 1.027196e+00 | 7.433413e-01 | 6.119264e-01 | 3.985649e-01 | 5.704361e-01 | 3.273459e-01 | 5.971390e-01 | 4.539234e-01 | 7.395934e-01 | 6.182380e-01 | 6.625050e-01 | 4.931498e-01 | 6.488208e-01 | 5.232963e-01 | 3.996750e-01 | 5.008067e-01 | 4.589494e-01 | 1.330408e-01 | 1.863772e-01 | 5.285536e-01 | 1.476421e-01 | 4.395266e-01 | 3.507156e-01 | 2.409522e-01 | 9.104512e-02 | 7.827995e-02 | 77.165000 | 0.000000 |

| max | 172792.000000 | 2.454930e+00 | 2.205773e+01 | 9.382558e+00 | 1.687534e+01 | 3.480167e+01 | 7.330163e+01 | 1.205895e+02 | 2.000721e+01 | 1.559499e+01 | 2.374514e+01 | 1.201891e+01 | 7.848392e+00 | 7.126883e+00 | 1.052677e+01 | 8.877742e+00 | 1.731511e+01 | 9.253526e+00 | 5.041069e+00 | 5.591971e+00 | 3.942090e+01 | 2.720284e+01 | 1.050309e+01 | 2.252841e+01 | 4.584549e+00 | 7.519589e+00 | 3.517346e+00 | 3.161220e+01 | 3.384781e+01 | 25691.160000 | 1.000000 |

# Good No Null Values!

df.isnull().sum().max()

0

df.columns

Index(['Time', 'V1', 'V2', 'V3', 'V4', 'V5', 'V6', 'V7', 'V8', 'V9', 'V10',

'V11', 'V12', 'V13', 'V14', 'V15', 'V16', 'V17', 'V18', 'V19', 'V20',

'V21', 'V22', 'V23', 'V24', 'V25', 'V26', 'V27', 'V28', 'Amount',

'Class'],

dtype='object')

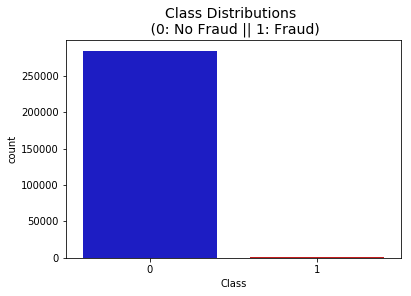

# The classes are heavily skewed we need to solve this issue later.

print('No Frauds', round(df['Class'].value_counts()[0]/len(df) * 100,2), '% of the dataset')

print('Frauds', round(df['Class'].value_counts()[1]/len(df) * 100,2), '% of the dataset')

No Frauds 99.83 % of the dataset

Frauds 0.17 % of the dataset

Note: Notice how imbalanced is our original dataset! Most of the transactions are non-fraud. If we use this dataframe as the base for our predictive models and analysis we might get a lot of errors and our algorithms will probably overfit since it will “assume” that most transactions are not fraud. But we don’t want our model to assume, we want our model to detect patterns that give signs of fraud!

colors = ["#0101DF", "#DF0101"]

sns.countplot('Class', data=df, palette=colors)

plt.title('Class Distributions \n (0: No Fraud || 1: Fraud)', fontsize=14)

Text(0.5, 1.0, 'Class Distributions \n (0: No Fraud || 1: Fraud)')

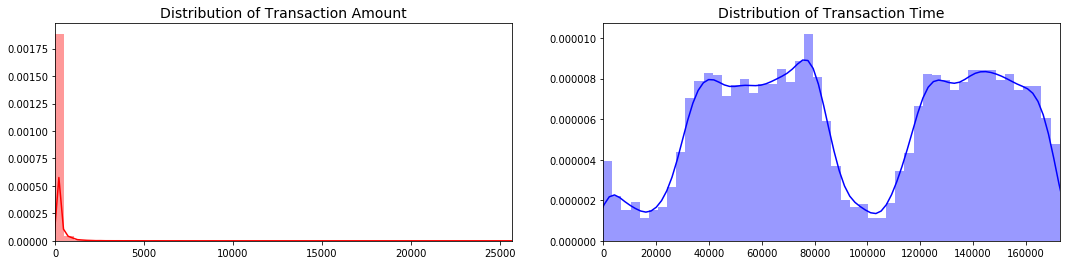

Distributions: By seeing the distributions we can have an idea how skewed are these features, we can also see further distributions of the other features. There are techniques that can help the distributions be less skewed which will be implemented in this notebook in the future.

fig, ax = plt.subplots(1, 2, figsize=(18,4))

amount_val = df['Amount'].values

time_val = df['Time'].values

sns.distplot(amount_val, ax=ax[0], color='r')

ax[0].set_title('Distribution of Transaction Amount', fontsize=14)

ax[0].set_xlim([min(amount_val), max(amount_val)])

sns.distplot(time_val, ax=ax[1], color='b')

ax[1].set_title('Distribution of Transaction Time', fontsize=14)

ax[1].set_xlim([min(time_val), max(time_val)])

plt.show()

Scaling and Distributing

In this phase of our kernel, we will first scale the columns comprise of Time and Amount . Time and amount should be scaled as the other columns. On the other hand, we need to also create a sub sample of the dataframe in order to have an equal amount of Fraud and Non-Fraud cases, helping our algorithms better understand patterns that determines whether a transaction is a fraud or not.What is a sub-Sample?

In this scenario, our subsample will be a dataframe with a 50/50 ratio of fraud and non-fraud transactions. Meaning our sub-sample will have the same amount of fraud and non fraud transactions.Why do we create a sub-Sample?

In the beginning of this notebook we saw that the original dataframe was heavily imbalanced! Using the original dataframe will cause the following issues:- Overfitting: Our classification models will assume that in most cases there are no frauds! What we want for our model is to be certain when a fraud occurs.

- Wrong Correlations: Although we don't know what the "V" features stand for, it will be useful to understand how each of this features influence the result (Fraud or No Fraud) by having an imbalance dataframe we are not able to see the true correlations between the class and features.

Summary:

- Scaled amount and scaled time are the columns with scaled values.

- There are 492 cases of fraud in our dataset so we can randomly get 492 cases of non-fraud to create our new sub dataframe.

- We concat the 492 cases of fraud and non fraud, creating a new sub-sample.

# Since most of our data has already been scaled we should scale the columns that are left to scale (Amount and Time)

from sklearn.preprocessing import StandardScaler, RobustScaler

# RobustScaler is less prone to outliers.

std_scaler = StandardScaler()

rob_scaler = RobustScaler()

df['scaled_amount'] = rob_scaler.fit_transform(df['Amount'].values.reshape(-1,1))

df['scaled_time'] = rob_scaler.fit_transform(df['Time'].values.reshape(-1,1))

df.drop(['Time','Amount'], axis=1, inplace=True)

scaled_amount = df['scaled_amount']

scaled_time = df['scaled_time']

df.drop(['scaled_amount', 'scaled_time'], axis=1, inplace=True)

df.insert(0, 'scaled_amount', scaled_amount)

df.insert(1, 'scaled_time', scaled_time)

# Amount and Time are Scaled!

df.head()

| scaled_amount | scaled_time | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Class | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 1.783274 | -0.994983 | -1.359807 | -0.072781 | 2.536347 | 1.378155 | -0.338321 | 0.462388 | 0.239599 | 0.098698 | 0.363787 | 0.090794 | -0.551600 | -0.617801 | -0.991390 | -0.311169 | 1.468177 | -0.470401 | 0.207971 | 0.025791 | 0.403993 | 0.251412 | -0.018307 | 0.277838 | -0.110474 | 0.066928 | 0.128539 | -0.189115 | 0.133558 | -0.021053 | 0 |

| 1 | -0.269825 | -0.994983 | 1.191857 | 0.266151 | 0.166480 | 0.448154 | 0.060018 | -0.082361 | -0.078803 | 0.085102 | -0.255425 | -0.166974 | 1.612727 | 1.065235 | 0.489095 | -0.143772 | 0.635558 | 0.463917 | -0.114805 | -0.183361 | -0.145783 | -0.069083 | -0.225775 | -0.638672 | 0.101288 | -0.339846 | 0.167170 | 0.125895 | -0.008983 | 0.014724 | 0 |

| 2 | 4.983721 | -0.994972 | -1.358354 | -1.340163 | 1.773209 | 0.379780 | -0.503198 | 1.800499 | 0.791461 | 0.247676 | -1.514654 | 0.207643 | 0.624501 | 0.066084 | 0.717293 | -0.165946 | 2.345865 | -2.890083 | 1.109969 | -0.121359 | -2.261857 | 0.524980 | 0.247998 | 0.771679 | 0.909412 | -0.689281 | -0.327642 | -0.139097 | -0.055353 | -0.059752 | 0 |

| 3 | 1.418291 | -0.994972 | -0.966272 | -0.185226 | 1.792993 | -0.863291 | -0.010309 | 1.247203 | 0.237609 | 0.377436 | -1.387024 | -0.054952 | -0.226487 | 0.178228 | 0.507757 | -0.287924 | -0.631418 | -1.059647 | -0.684093 | 1.965775 | -1.232622 | -0.208038 | -0.108300 | 0.005274 | -0.190321 | -1.175575 | 0.647376 | -0.221929 | 0.062723 | 0.061458 | 0 |

| 4 | 0.670579 | -0.994960 | -1.158233 | 0.877737 | 1.548718 | 0.403034 | -0.407193 | 0.095921 | 0.592941 | -0.270533 | 0.817739 | 0.753074 | -0.822843 | 0.538196 | 1.345852 | -1.119670 | 0.175121 | -0.451449 | -0.237033 | -0.038195 | 0.803487 | 0.408542 | -0.009431 | 0.798278 | -0.137458 | 0.141267 | -0.206010 | 0.502292 | 0.219422 | 0.215153 | 0 |

Splitting the Data (Original DataFrame)#

Before proceeding with the Random UnderSampling technique we have to separate the orginal dataframe. Why? for testing purposes, remember although we are splitting the data when implementing Random UnderSampling or OverSampling techniques, we want to test our models on the original testing set not on the testing set created by either of these techniques. The main goal is to fit the model either with the dataframes that were undersample and oversample (in order for our models to detect the patterns), and test it on the original testing set.

from sklearn.model_selection import train_test_split

from sklearn.model_selection import StratifiedShuffleSplit

print('No Frauds', round(df['Class'].value_counts()[0]/len(df) * 100,2), '% of the dataset')

print('Frauds', round(df['Class'].value_counts()[1]/len(df) * 100,2), '% of the dataset')

X = df.drop('Class', axis=1)

y = df['Class']

sss = StratifiedKFold(n_splits=5, random_state=None, shuffle=False)

for train_index, test_index in sss.split(X, y):

print("Train:", train_index, "Test:", test_index)

original_Xtrain, original_Xtest = X.iloc[train_index], X.iloc[test_index]

original_ytrain, original_ytest = y.iloc[train_index], y.iloc[test_index]

# We already have X_train and y_train for undersample data thats why I am using original to distinguish and to not overwrite these variables.

# original_Xtrain, original_Xtest, original_ytrain, original_ytest = train_test_split(X, y, test_size=0.2, random_state=42)

# Check the Distribution of the labels

# Turn into an array

original_Xtrain = original_Xtrain.values

original_Xtest = original_Xtest.values

original_ytrain = original_ytrain.values

original_ytest = original_ytest.values

# See if both the train and test label distribution are similarly distributed

train_unique_label, train_counts_label = np.unique(original_ytrain, return_counts=True)

test_unique_label, test_counts_label = np.unique(original_ytest, return_counts=True)

print('-' * 100)

print('Label Distributions: \n')

print(train_counts_label/ len(original_ytrain))

print(test_counts_label/ len(original_ytest))

No Frauds 99.83 % of the dataset

Frauds 0.17 % of the dataset

Train: [ 30473 30496 31002 ... 284804 284805 284806] Test: [ 0 1 2 ... 57017 57018 57019]

Train: [ 0 1 2 ... 284804 284805 284806] Test: [ 30473 30496 31002 ... 113964 113965 113966]

Train: [ 0 1 2 ... 284804 284805 284806] Test: [ 81609 82400 83053 ... 170946 170947 170948]

Train: [ 0 1 2 ... 284804 284805 284806] Test: [150654 150660 150661 ... 227866 227867 227868]

Train: [ 0 1 2 ... 227866 227867 227868] Test: [212516 212644 213092 ... 284804 284805 284806]

----------------------------------------------------------------------------------------------------

Label Distributions:

[0.99827076 0.00172924]

[0.99827952 0.00172048]

Random Under-Sampling:#

In this phase of the project we will implement “Random Under Sampling” which basically consists of removing data in order to have a more balanced dataset and thus avoiding our models to overfitting.

Steps:#

- The first thing we have to do is determine how imbalanced is our class (use "value_counts()" on the class column to determine the amount for each label)

- Once we determine how many instances are considered fraud transactions (Fraud = "1") , we should bring the non-fraud transactions to the same amount as fraud transactions (assuming we want a 50/50 ratio), this will be equivalent to 492 cases of fraud and 492 cases of non-fraud transactions.

- After implementing this technique, we have a sub-sample of our dataframe with a 50/50 ratio with regards to our classes. Then the next step we will implement is to shuffle the data to see if our models can maintain a certain accuracy everytime we run this script.

Note: The main issue with “Random Under-Sampling” is that we run the risk that our classification models will not perform as accurate as we would like to since there is a great deal of information loss (bringing 492 non-fraud transaction from 284,315 non-fraud transaction)

# Since our classes are highly skewed we should make them equivalent in order to have a normal distribution of the classes.

# Lets shuffle the data before creating the subsamples

df = df.sample(frac=1)

# amount of fraud classes 492 rows.

fraud_df = df.loc[df['Class'] == 1]

non_fraud_df = df.loc[df['Class'] == 0][:492]

normal_distributed_df = pd.concat([fraud_df, non_fraud_df])

# Shuffle dataframe rows

new_df = normal_distributed_df.sample(frac=1, random_state=42)

new_df.head()

| scaled_amount | scaled_time | V1 | V2 | V3 | V4 | V5 | V6 | V7 | V8 | V9 | V10 | V11 | V12 | V13 | V14 | V15 | V16 | V17 | V18 | V19 | V20 | V21 | V22 | V23 | V24 | V25 | V26 | V27 | V28 | Class | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 35719 | 0.368616 | -0.545789 | -0.887048 | 0.561889 | 0.906573 | 0.385667 | 1.739388 | 4.465832 | -0.568384 | 1.012247 | -0.073614 | 0.142165 | -0.412621 | -0.266949 | 0.133484 | -0.225193 | 1.643363 | -0.195570 | -0.270580 | 1.003391 | 1.811364 | 0.198640 | 0.161127 | 0.431808 | -0.380335 | 1.045194 | 0.340769 | 0.004459 | -0.240767 | 0.153636 | 0 |

| 154670 | 1.145812 | 0.209084 | -2.296987 | 4.064043 | -5.957706 | 4.680008 | -2.080938 | -1.463272 | -4.490847 | 1.029246 | -1.593249 | -8.993811 | 7.864467 | -10.649840 | 1.826591 | -12.913632 | -0.766330 | -7.954098 | -7.809635 | -1.718511 | 3.832985 | 1.264954 | 1.089084 | 0.975398 | -0.625530 | -0.535181 | 0.247435 | 0.160400 | 0.969582 | 0.335041 | 1 |

| 59856 | -0.125900 | -0.418872 | 1.205206 | -0.041657 | 0.935974 | 1.145439 | -0.547338 | 0.289337 | -0.551764 | 0.125960 | 0.900694 | -0.211548 | -1.486680 | 0.373892 | 0.498039 | -0.472276 | 0.205412 | 0.308328 | -0.571202 | 0.173169 | 0.101632 | -0.079117 | -0.111767 | -0.103876 | -0.114961 | -0.436178 | 0.536396 | -0.358637 | 0.072760 | 0.031139 | 0 |

| 14170 | 1.089779 | -0.698951 | -15.903635 | 10.393917 | -19.133602 | 6.185969 | -12.538021 | -4.027030 | -13.897827 | 10.662252 | -2.844954 | -9.668789 | 7.394419 | -11.635630 | 1.423277 | -8.640459 | -0.674720 | -7.695569 | -13.684140 | -4.777406 | 1.268343 | 1.501565 | 1.577548 | -1.280137 | -0.601295 | 0.040404 | 0.995502 | -0.273743 | 1.688136 | 0.527831 | 1 |

| 8842 | -0.307413 | -0.852912 | -4.696795 | 2.693867 | -4.475133 | 5.467685 | -1.556758 | -1.549420 | -4.104215 | 0.553934 | -1.498468 | -4.594952 | 5.275506 | -11.349029 | 0.374549 | -8.138695 | 0.548571 | -6.653594 | -10.246755 | -4.191066 | 0.991486 | -0.158971 | 0.573898 | -0.080163 | 0.318408 | -0.245862 | 0.338238 | 0.032271 | -1.508458 | 0.608075 | 1 |

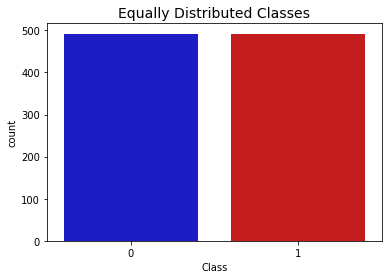

Equally Distributing and Correlating:#

Now that we have our dataframe correctly balanced, we can go further with our analysis and data preprocessing.

print('Distribution of the Classes in the subsample dataset')

print(new_df['Class'].value_counts()/len(new_df))

sns.countplot('Class', data=new_df, palette=colors)

plt.title('Equally Distributed Classes', fontsize=14)

plt.show()

Distribution of the Classes in the subsample dataset

1 0.5

0 0.5

Name: Class, dtype: float64

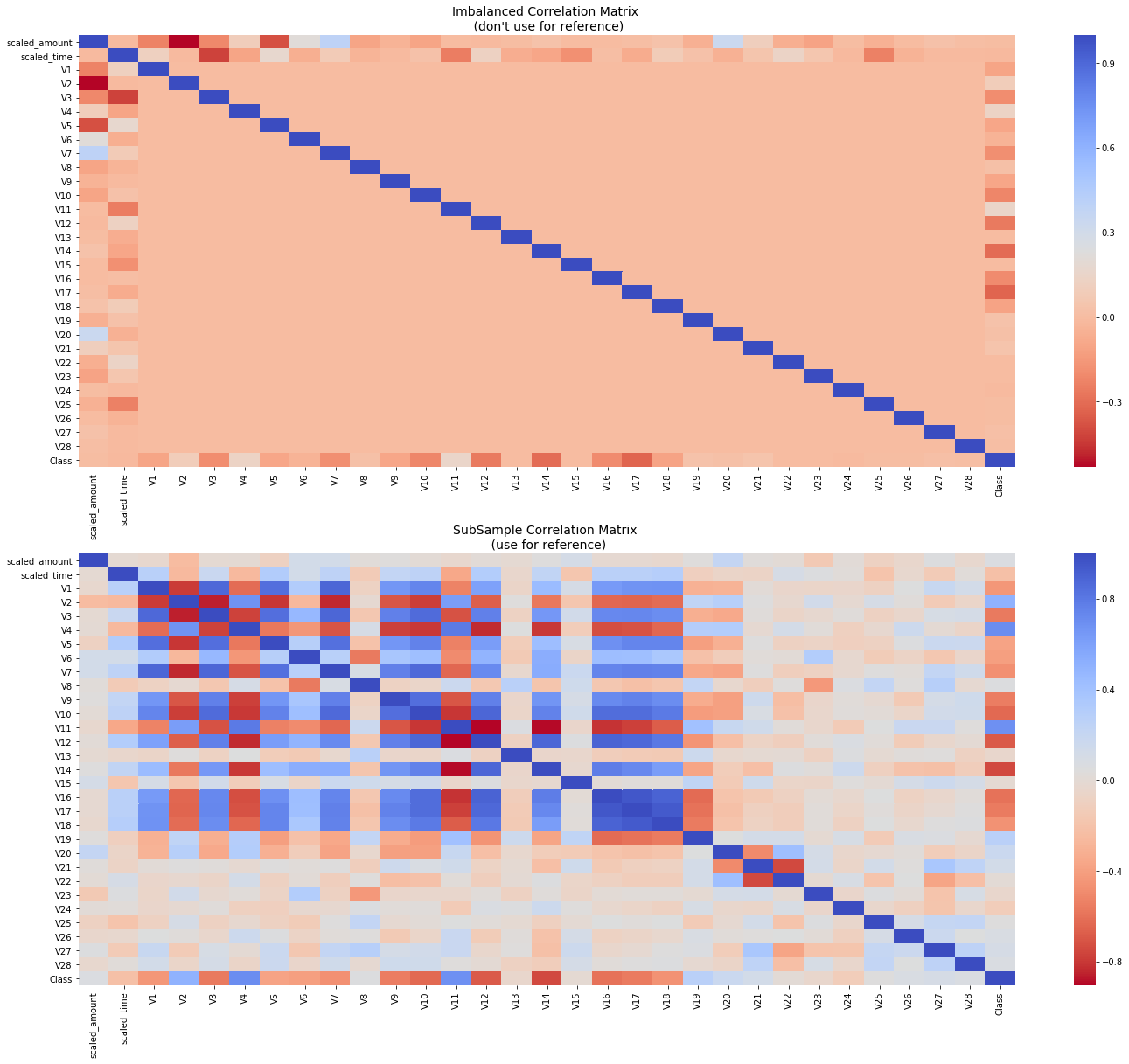

Correlation Matrices

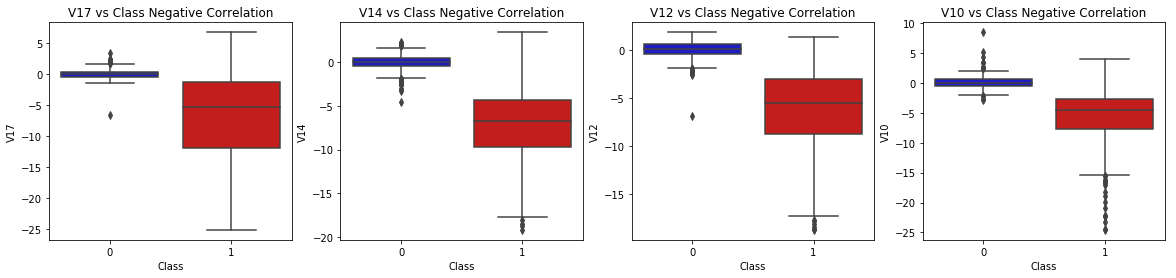

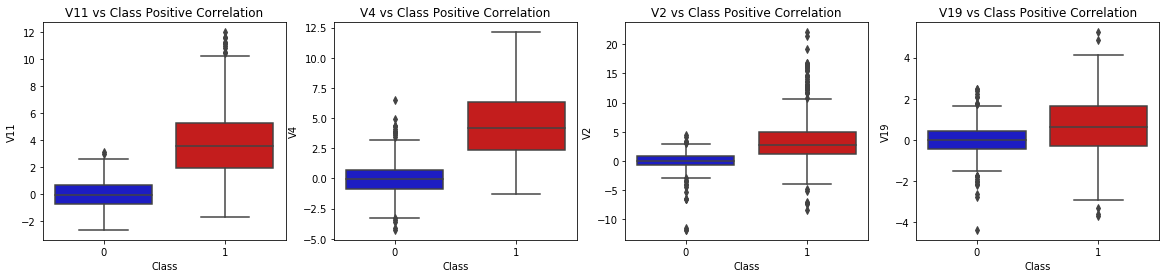

Correlation matrices are the essence of understanding our data. We want to know if there are features that influence heavily in whether a specific transaction is a fraud. However, it is important that we use the correct dataframe (subsample) in order for us to see which features have a high positive or negative correlation with regards to fraud transactions.Summary and Explanation:#

- Negative Correlations: V17, V14, V12 and V10 are negatively correlated. Notice how the lower these values are, the more likely the end result will be a fraud transaction.

- Positive Correlations: V2, V4, V11, and V19 are positively correlated. Notice how the higher these values are, the more likely the end result will be a fraud transaction.

- BoxPlots: We will use boxplots to have a better understanding of the distribution of these features in fradulent and non fradulent transactions.

**Note: ** We have to make sure we use the subsample in our correlation matrix or else our correlation matrix will be affected by the high imbalance between our classes. This occurs due to the high class imbalance in the original dataframe.

# Make sure we use the subsample in our correlation

f, (ax1, ax2) = plt.subplots(2, 1, figsize=(24,20))

# Entire DataFrame

corr = df.corr()

sns.heatmap(corr, cmap='coolwarm_r', annot_kws={'size':20}, ax=ax1)

ax1.set_title("Imbalanced Correlation Matrix \n (don't use for reference)", fontsize=14)

sub_sample_corr = new_df.corr()

sns.heatmap(sub_sample_corr, cmap='coolwarm_r', annot_kws={'size':20}, ax=ax2)

ax2.set_title('SubSample Correlation Matrix \n (use for reference)', fontsize=14)

plt.show()

f, axes = plt.subplots(ncols=4, figsize=(20,4))

# Negative Correlations with our Class (The lower our feature value the more likely it will be a fraud transaction)

sns.boxplot(x="Class", y="V17", data=new_df, palette=colors, ax=axes[0])

axes[0].set_title('V17 vs Class Negative Correlation')

sns.boxplot(x="Class", y="V14", data=new_df, palette=colors, ax=axes[1])

axes[1].set_title('V14 vs Class Negative Correlation')

sns.boxplot(x="Class", y="V12", data=new_df, palette=colors, ax=axes[2])

axes[2].set_title('V12 vs Class Negative Correlation')

sns.boxplot(x="Class", y="V10", data=new_df, palette=colors, ax=axes[3])

axes[3].set_title('V10 vs Class Negative Correlation')

plt.show()

f, axes = plt.subplots(ncols=4, figsize=(20,4))

# Positive correlations (The higher the feature the probability increases that it will be a fraud transaction)

sns.boxplot(x="Class", y="V11", data=new_df, palette=colors, ax=axes[0])

axes[0].set_title('V11 vs Class Positive Correlation')

sns.boxplot(x="Class", y="V4", data=new_df, palette=colors, ax=axes[1])

axes[1].set_title('V4 vs Class Positive Correlation')

sns.boxplot(x="Class", y="V2", data=new_df, palette=colors, ax=axes[2])

axes[2].set_title('V2 vs Class Positive Correlation')

sns.boxplot(x="Class", y="V19", data=new_df, palette=colors, ax=axes[3])

axes[3].set_title('V19 vs Class Positive Correlation')

plt.show()

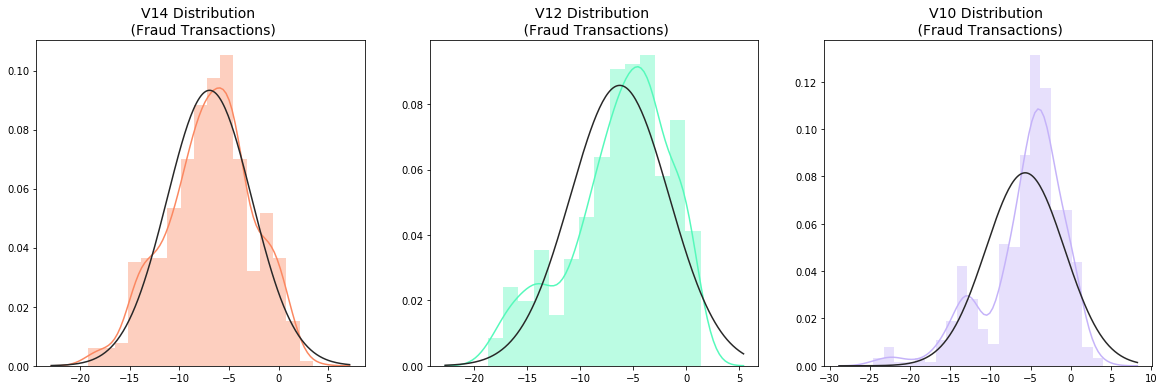

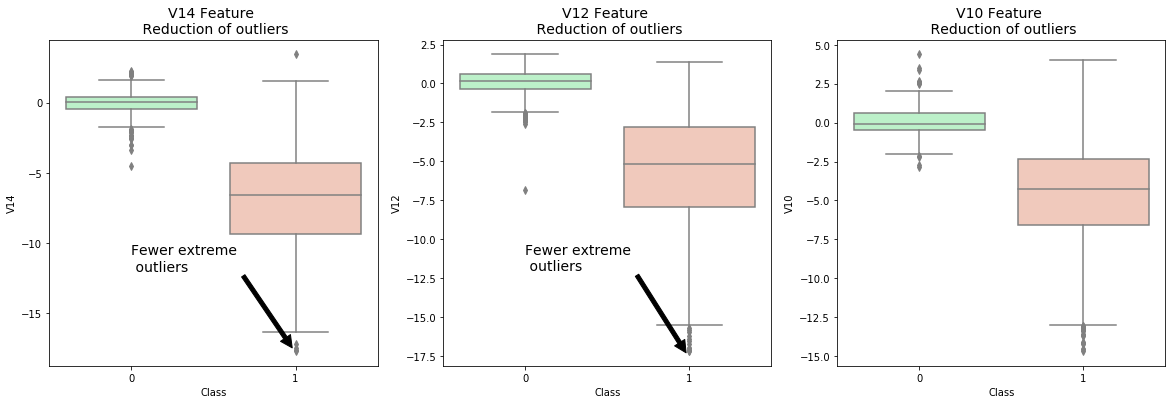

Anomaly Detection:#

Our main aim in this section is to remove “extreme outliers” from features that have a high correlation with our classes. This will have a positive impact on the accuracy of our models.

Interquartile Range Method:#

- Interquartile Range (IQR): We calculate this by the difference between the 75th percentile and 25th percentile. Our aim is to create a threshold beyond the 75th and 25th percentile that in case some instance pass this threshold the instance will be deleted.

- Boxplots: Besides easily seeing the 25th and 75th percentiles (both end of the squares) it is also easy to see extreme outliers (points beyond the lower and higher extreme).

Outlier Removal Tradeoff:#

We have to be careful as to how far do we want the threshold for removing outliers. We determine the threshold by multiplying a number (ex: 1.5) by the (Interquartile Range). The higher this threshold is, the less outliers will detect (multiplying by a higher number ex: 3), and the lower this threshold is the more outliers it will detect.

**The Tradeoff: ** The lower the threshold the more outliers it will remove however, we want to focus more on “extreme outliers” rather than just outliers. Why? because we might run the risk of information loss which will cause our models to have a lower accuracy. You can play with this threshold and see how it affects the accuracy of our classification models.

Summary:#

- Visualize Distributions: We first start by visualizing the distribution of the feature we are going to use to eliminate some of the outliers. V14 is the only feature that has a Gaussian distribution compared to features V12 and V10.

- Determining the threshold: After we decide which number we will use to multiply with the iqr (the lower more outliers removed), we will proceed in determining the upper and lower thresholds by substrating q25 - threshold (lower extreme threshold) and adding q75 + threshold (upper extreme threshold).

- Conditional Dropping: Lastly, we create a conditional dropping stating that if the "threshold" is exceeded in both extremes, the instances will be removed.

- Boxplot Representation: Visualize through the boxplot that the number of "extreme outliers" have been reduced to a considerable amount.

Note: After implementing outlier reduction our accuracy has been improved by over 3%! Some outliers can distort the accuracy of our models but remember, we have to avoid an extreme amount of information loss or else our model runs the risk of underfitting.

from scipy.stats import norm

f, (ax1, ax2, ax3) = plt.subplots(1,3, figsize=(20, 6))

v14_fraud_dist = new_df['V14'].loc[new_df['Class'] == 1].values

sns.distplot(v14_fraud_dist,ax=ax1, fit=norm, color='#FB8861')

ax1.set_title('V14 Distribution \n (Fraud Transactions)', fontsize=14)

v12_fraud_dist = new_df['V12'].loc[new_df['Class'] == 1].values

sns.distplot(v12_fraud_dist,ax=ax2, fit=norm, color='#56F9BB')

ax2.set_title('V12 Distribution \n (Fraud Transactions)', fontsize=14)

v10_fraud_dist = new_df['V10'].loc[new_df['Class'] == 1].values

sns.distplot(v10_fraud_dist,ax=ax3, fit=norm, color='#C5B3F9')

ax3.set_title('V10 Distribution \n (Fraud Transactions)', fontsize=14)

plt.show()

# # -----> V14 Removing Outliers (Highest Negative Correlated with Labels)

v14_fraud = new_df['V14'].loc[new_df['Class'] == 1].values

q25, q75 = np.percentile(v14_fraud, 25), np.percentile(v14_fraud, 75)

print('Quartile 25: {} | Quartile 75: {}'.format(q25, q75))

v14_iqr = q75 - q25

print('iqr: {}'.format(v14_iqr))

v14_cut_off = v14_iqr * 1.5

v14_lower, v14_upper = q25 - v14_cut_off, q75 + v14_cut_off

print('Cut Off: {}'.format(v14_cut_off))

print('V14 Lower: {}'.format(v14_lower))

print('V14 Upper: {}'.format(v14_upper))

outliers = [x for x in v14_fraud if x < v14_lower or x > v14_upper]

print('Feature V14 Outliers for Fraud Cases: {}'.format(len(outliers)))

print('V10 outliers:{}'.format(outliers))

new_df = new_df.drop(new_df[(new_df['V14'] > v14_upper) | (new_df['V14'] < v14_lower)].index)

print('----' * 44)

# -----> V12 removing outliers from fraud transactions

v12_fraud = new_df['V12'].loc[new_df['Class'] == 1].values

q25, q75 = np.percentile(v12_fraud, 25), np.percentile(v12_fraud, 75)

v12_iqr = q75 - q25

v12_cut_off = v12_iqr * 1.5

v12_lower, v12_upper = q25 - v12_cut_off, q75 + v12_cut_off

print('V12 Lower: {}'.format(v12_lower))

print('V12 Upper: {}'.format(v12_upper))

outliers = [x for x in v12_fraud if x < v12_lower or x > v12_upper]

print('V12 outliers: {}'.format(outliers))

print('Feature V12 Outliers for Fraud Cases: {}'.format(len(outliers)))

new_df = new_df.drop(new_df[(new_df['V12'] > v12_upper) | (new_df['V12'] < v12_lower)].index)

print('Number of Instances after outliers removal: {}'.format(len(new_df)))

print('----' * 44)

# Removing outliers V10 Feature

v10_fraud = new_df['V10'].loc[new_df['Class'] == 1].values

q25, q75 = np.percentile(v10_fraud, 25), np.percentile(v10_fraud, 75)

v10_iqr = q75 - q25

v10_cut_off = v10_iqr * 1.5

v10_lower, v10_upper = q25 - v10_cut_off, q75 + v10_cut_off

print('V10 Lower: {}'.format(v10_lower))

print('V10 Upper: {}'.format(v10_upper))

outliers = [x for x in v10_fraud if x < v10_lower or x > v10_upper]

print('V10 outliers: {}'.format(outliers))

print('Feature V10 Outliers for Fraud Cases: {}'.format(len(outliers)))

new_df = new_df.drop(new_df[(new_df['V10'] > v10_upper) | (new_df['V10'] < v10_lower)].index)

print('Number of Instances after outliers removal: {}'.format(len(new_df)))

Quartile 25: -9.692722964972385 | Quartile 75: -4.282820849486866

iqr: 5.409902115485519

Cut Off: 8.114853173228278

V14 Lower: -17.807576138200663

V14 Upper: 3.8320323237414122

Feature V14 Outliers for Fraud Cases: 4

V10 outliers:[-19.2143254902614, -18.8220867423816, -18.4937733551053, -18.049997689859396]

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

V12 Lower: -17.3430371579634

V12 Upper: 5.776973384895937

V12 outliers: [-18.683714633344298, -18.047596570821604, -18.4311310279993, -18.553697009645802]

Feature V12 Outliers for Fraud Cases: 4

Number of Instances after outliers removal: 976

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

V10 Lower: -14.89885463232024

V10 Upper: 4.920334958342141

V10 outliers: [-24.403184969972802, -18.9132433348732, -15.124162814494698, -16.3035376590131, -15.2399619587112, -15.1237521803455, -14.9246547735487, -16.6496281595399, -18.2711681738888, -24.5882624372475, -15.346098846877501, -20.949191554361104, -15.2399619587112, -23.2282548357516, -15.2318333653018, -22.1870885620007, -17.141513641289198, -19.836148851696, -22.1870885620007, -16.6011969664137, -16.7460441053944, -15.563791338730098, -14.9246547735487, -16.2556117491401, -22.1870885620007, -15.563791338730098, -22.1870885620007]

Feature V10 Outliers for Fraud Cases: 27

Number of Instances after outliers removal: 947

f,(ax1, ax2, ax3) = plt.subplots(1, 3, figsize=(20,6))

colors = ['#B3F9C5', '#f9c5b3']

# Boxplots with outliers removed

# Feature V14

sns.boxplot(x="Class", y="V14", data=new_df,ax=ax1, palette=colors)

ax1.set_title("V14 Feature \n Reduction of outliers", fontsize=14)

ax1.annotate('Fewer extreme \n outliers', xy=(0.98, -17.5), xytext=(0, -12),

arrowprops=dict(facecolor='black'),

fontsize=14)

# Feature 12

sns.boxplot(x="Class", y="V12", data=new_df, ax=ax2, palette=colors)

ax2.set_title("V12 Feature \n Reduction of outliers", fontsize=14)

ax2.annotate('Fewer extreme \n outliers', xy=(0.98, -17.3), xytext=(0, -12),

arrowprops=dict(facecolor='black'),

fontsize=14)

# Feature V10

sns.boxplot(x="Class", y="V10", data=new_df, ax=ax3, palette=colors)

ax3.set_title("V10 Feature \n Reduction of outliers", fontsize=14)

ax3.annotate('Fewer extreme \n outliers', xy=(0.95, -16.5), xytext=(0, -12),

arrowprops=dict(facecolor='black'),

fontsize=14)

plt.show()

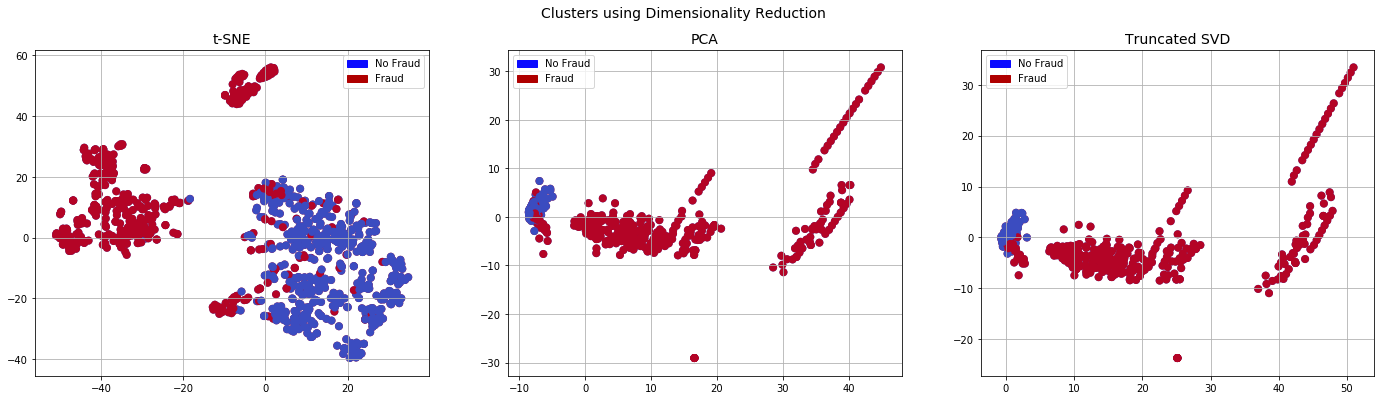

Dimensionality Reduction and Clustering:

Understanding t-SNE:

In order to understand this algorithm you have to understand the following terms:- Euclidean Distance

- Conditional Probability

- Normal and T-Distribution Plots

Summary:

- t-SNE algorithm can pretty accurately cluster the cases that were fraud and non-fraud in our dataset.

- Although the subsample is pretty small, the t-SNE algorithm is able to detect clusters pretty accurately in every scenario (I shuffle the dataset before running t-SNE)

- This gives us an indication that further predictive models will perform pretty well in separating fraud cases from non-fraud cases.

# New_df is from the random undersample data (fewer instances)

X = new_df.drop('Class', axis=1)

y = new_df['Class']

# T-SNE Implementation

t0 = time.time()

X_reduced_tsne = TSNE(n_components=2, random_state=42).fit_transform(X.values)

t1 = time.time()

print("T-SNE took {:.2} s".format(t1 - t0))

# PCA Implementation

t0 = time.time()

X_reduced_pca = PCA(n_components=2, random_state=42).fit_transform(X.values)

t1 = time.time()

print("PCA took {:.2} s".format(t1 - t0))

# TruncatedSVD

t0 = time.time()

X_reduced_svd = TruncatedSVD(n_components=2, algorithm='randomized', random_state=42).fit_transform(X.values)

t1 = time.time()

print("Truncated SVD took {:.2} s".format(t1 - t0))

T-SNE took 7.0 s

PCA took 0.032 s

Truncated SVD took 0.0051 s

f, (ax1, ax2, ax3) = plt.subplots(1, 3, figsize=(24,6))

# labels = ['No Fraud', 'Fraud']

f.suptitle('Clusters using Dimensionality Reduction', fontsize=14)

blue_patch = mpatches.Patch(color='#0A0AFF', label='No Fraud')

red_patch = mpatches.Patch(color='#AF0000', label='Fraud')

# t-SNE scatter plot

ax1.scatter(X_reduced_tsne[:,0], X_reduced_tsne[:,1], c=(y == 0), cmap='coolwarm', label='No Fraud', linewidths=2)

ax1.scatter(X_reduced_tsne[:,0], X_reduced_tsne[:,1], c=(y == 1), cmap='coolwarm', label='Fraud', linewidths=2)

ax1.set_title('t-SNE', fontsize=14)

ax1.grid(True)

ax1.legend(handles=[blue_patch, red_patch])

# PCA scatter plot

ax2.scatter(X_reduced_pca[:,0], X_reduced_pca[:,1], c=(y == 0), cmap='coolwarm', label='No Fraud', linewidths=2)

ax2.scatter(X_reduced_pca[:,0], X_reduced_pca[:,1], c=(y == 1), cmap='coolwarm', label='Fraud', linewidths=2)

ax2.set_title('PCA', fontsize=14)

ax2.grid(True)

ax2.legend(handles=[blue_patch, red_patch])

# TruncatedSVD scatter plot

ax3.scatter(X_reduced_svd[:,0], X_reduced_svd[:,1], c=(y == 0), cmap='coolwarm', label='No Fraud', linewidths=2)

ax3.scatter(X_reduced_svd[:,0], X_reduced_svd[:,1], c=(y == 1), cmap='coolwarm', label='Fraud', linewidths=2)

ax3.set_title('Truncated SVD', fontsize=14)

ax3.grid(True)

ax3.legend(handles=[blue_patch, red_patch])

plt.show()

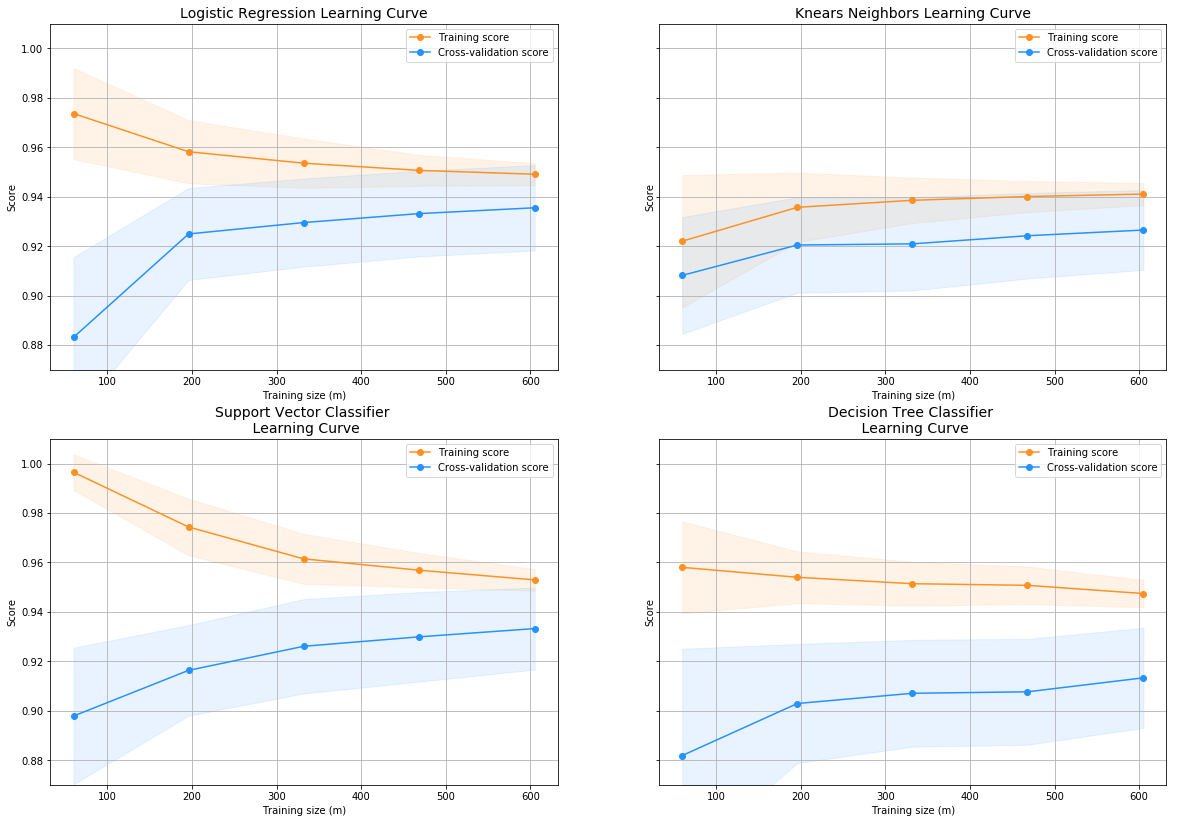

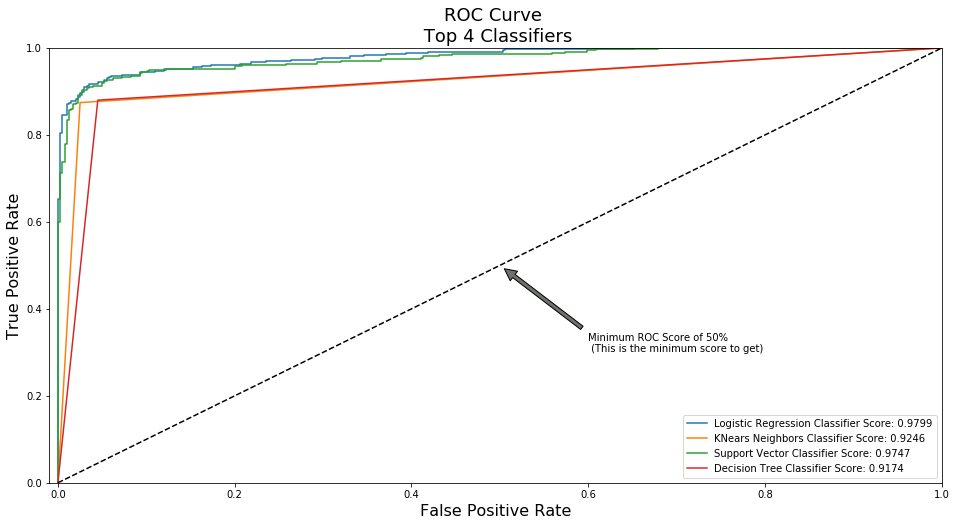

Classifiers (UnderSampling):

In this section we will train four types of classifiers and decide which classifier will be more effective in detecting fraud transactions. Before we have to split our data into training and testing sets and separate the features from the labels.Summary:#

- Logistic Regression classifier is more accurate than the other three classifiers in most cases. (We will further analyze Logistic Regression)

- GridSearchCV is used to determine the paremeters that gives the best predictive score for the classifiers.

- Logistic Regression has the best Receiving Operating Characteristic score (ROC), meaning that LogisticRegression pretty accurately separates fraud and non-fraud transactions.

Learning Curves:#

- The wider the gap between the training score and the cross validation score, the more likely your model is overfitting (high variance).

- If the score is low in both training and cross-validation sets this is an indication that our model is underfitting (high bias)

- Logistic Regression Classifier shows the best score in both training and cross-validating sets.

# Undersampling before cross validating (prone to overfit)

X = new_df.drop('Class', axis=1)

y = new_df['Class']

# Our data is already scaled we should split our training and test sets

from sklearn.model_selection import train_test_split

# This is explicitly used for undersampling.

X_train, X_test, y_train, y_test = train_test_split(X, y, test_size=0.2, random_state=42)

# Turn the values into an array for feeding the classification algorithms.

X_train = X_train.values

X_test = X_test.values

y_train = y_train.values

y_test = y_test.values

# Let's implement simple classifiers

classifiers = {

"LogisiticRegression": LogisticRegression(),

"KNearest": KNeighborsClassifier(),

"Support Vector Classifier": SVC(),

"DecisionTreeClassifier": DecisionTreeClassifier()

}

# Wow our scores are getting even high scores even when applying cross validation.

from sklearn.model_selection import cross_val_score

for key, classifier in classifiers.items():

classifier.fit(X_train, y_train)

training_score = cross_val_score(classifier, X_train, y_train, cv=5)

print("Classifiers: ", classifier.__class__.__name__, "Has a training score of", round(training_score.mean(), 2) * 100, "% accuracy score")

Classifiers: LogisticRegression Has a training score of 95.0 % accuracy score

Classifiers: KNeighborsClassifier Has a training score of 93.0 % accuracy score

Classifiers: SVC Has a training score of 92.0 % accuracy score

Classifiers: DecisionTreeClassifier Has a training score of 88.0 % accuracy score

# Use GridSearchCV to find the best parameters.

from sklearn.model_selection import GridSearchCV

# Logistic Regression

log_reg_params = {"penalty": ['l1', 'l2'], 'C': [0.001, 0.01, 0.1, 1, 10, 100, 1000]}

grid_log_reg = GridSearchCV(LogisticRegression(), log_reg_params)

grid_log_reg.fit(X_train, y_train)

# We automatically get the logistic regression with the best parameters.

log_reg = grid_log_reg.best_estimator_

knears_params = {"n_neighbors": list(range(2,5,1)), 'algorithm': ['auto', 'ball_tree', 'kd_tree', 'brute']}

grid_knears = GridSearchCV(KNeighborsClassifier(), knears_params)

grid_knears.fit(X_train, y_train)

# KNears best estimator

knears_neighbors = grid_knears.best_estimator_

# Support Vector Classifier

svc_params = {'C': [0.5, 0.7, 0.9, 1], 'kernel': ['rbf', 'poly', 'sigmoid', 'linear']}

grid_svc = GridSearchCV(SVC(), svc_params)

grid_svc.fit(X_train, y_train)

# SVC best estimator

svc = grid_svc.best_estimator_

# DecisionTree Classifier

tree_params = {"criterion": ["gini", "entropy"], "max_depth": list(range(2,4,1)),

"min_samples_leaf": list(range(5,7,1))}

grid_tree = GridSearchCV(DecisionTreeClassifier(), tree_params)

grid_tree.fit(X_train, y_train)

# tree best estimator

tree_clf = grid_tree.best_estimator_

# Overfitting Case

log_reg_score = cross_val_score(log_reg, X_train, y_train, cv=5)

print('Logistic Regression Cross Validation Score: ', round(log_reg_score.mean() * 100, 2).astype(str) + '%')

knears_score = cross_val_score(knears_neighbors, X_train, y_train, cv=5)

print('Knears Neighbors Cross Validation Score', round(knears_score.mean() * 100, 2).astype(str) + '%')

svc_score = cross_val_score(svc, X_train, y_train, cv=5)

print('Support Vector Classifier Cross Validation Score', round(svc_score.mean() * 100, 2).astype(str) + '%')

tree_score = cross_val_score(tree_clf, X_train, y_train, cv=5)

print('DecisionTree Classifier Cross Validation Score', round(tree_score.mean() * 100, 2).astype(str) + '%')

Logistic Regression Cross Validation Score: 94.05%

Knears Neighbors Cross Validation Score 92.73%

Support Vector Classifier Cross Validation Score 93.79%

DecisionTree Classifier Cross Validation Score 91.41%

# We will undersample during cross validating

undersample_X = df.drop('Class', axis=1)

undersample_y = df['Class']

for train_index, test_index in sss.split(undersample_X, undersample_y):

print("Train:", train_index, "Test:", test_index)

undersample_Xtrain, undersample_Xtest = undersample_X.iloc[train_index], undersample_X.iloc[test_index]

undersample_ytrain, undersample_ytest = undersample_y.iloc[train_index], undersample_y.iloc[test_index]

undersample_Xtrain = undersample_Xtrain.values

undersample_Xtest = undersample_Xtest.values

undersample_ytrain = undersample_ytrain.values

undersample_ytest = undersample_ytest.values

undersample_accuracy = []

undersample_precision = []

undersample_recall = []

undersample_f1 = []

undersample_auc = []

# Implementing NearMiss Technique

# Distribution of NearMiss (Just to see how it distributes the labels we won't use these variables)

X_nearmiss, y_nearmiss = NearMiss().fit_sample(undersample_X.values, undersample_y.values)

print('NearMiss Label Distribution: {}'.format(Counter(y_nearmiss)))

# Cross Validating the right way

for train, test in sss.split(undersample_Xtrain, undersample_ytrain):

undersample_pipeline = imbalanced_make_pipeline(NearMiss(sampling_strategy='majority'), log_reg) # SMOTE happens during Cross Validation not before..

undersample_model = undersample_pipeline.fit(undersample_Xtrain[train], undersample_ytrain[train])

undersample_prediction = undersample_model.predict(undersample_Xtrain[test])

undersample_accuracy.append(undersample_pipeline.score(original_Xtrain[test], original_ytrain[test]))

undersample_precision.append(precision_score(original_ytrain[test], undersample_prediction))

undersample_recall.append(recall_score(original_ytrain[test], undersample_prediction))

undersample_f1.append(f1_score(original_ytrain[test], undersample_prediction))

undersample_auc.append(roc_auc_score(original_ytrain[test], undersample_prediction))

Train: [ 56959 56960 56961 ... 284804 284805 284806] Test: [ 0 1 2 ... 57174 58268 58463]

Train: [ 0 1 2 ... 284804 284805 284806] Test: [ 56959 56960 56961 ... 115109 116514 116648]

Train: [ 0 1 2 ... 284804 284805 284806] Test: [113919 113920 113921 ... 170890 170891 170892]

Train: [ 0 1 2 ... 284804 284805 284806] Test: [168136 168614 168817 ... 228955 229310 229751]

Train: [ 0 1 2 ... 228955 229310 229751] Test: [227842 227843 227844 ... 284804 284805 284806]

NearMiss Label Distribution: Counter({0: 492, 1: 492})

# Let's Plot LogisticRegression Learning Curve

from sklearn.model_selection import ShuffleSplit

from sklearn.model_selection import learning_curve

def plot_learning_curve(estimator1, estimator2, estimator3, estimator4, X, y, ylim=None, cv=None,

n_jobs=1, train_sizes=np.linspace(.1, 1.0, 5)):

f, ((ax1, ax2), (ax3, ax4)) = plt.subplots(2,2, figsize=(20,14), sharey=True)

if ylim is not None:

plt.ylim(*ylim)

# First Estimator

train_sizes, train_scores, test_scores = learning_curve(

estimator1, X, y, cv=cv, n_jobs=n_jobs, train_sizes=train_sizes)

train_scores_mean = np.mean(train_scores, axis=1)

train_scores_std = np.std(train_scores, axis=1)

test_scores_mean = np.mean(test_scores, axis=1)

test_scores_std = np.std(test_scores, axis=1)

ax1.fill_between(train_sizes, train_scores_mean - train_scores_std,

train_scores_mean + train_scores_std, alpha=0.1,

color="#ff9124")

ax1.fill_between(train_sizes, test_scores_mean - test_scores_std,

test_scores_mean + test_scores_std, alpha=0.1, color="#2492ff")

ax1.plot(train_sizes, train_scores_mean, 'o-', color="#ff9124",

label="Training score")

ax1.plot(train_sizes, test_scores_mean, 'o-', color="#2492ff",

label="Cross-validation score")

ax1.set_title("Logistic Regression Learning Curve", fontsize=14)

ax1.set_xlabel('Training size (m)')

ax1.set_ylabel('Score')

ax1.grid(True)

ax1.legend(loc="best")

# Second Estimator

train_sizes, train_scores, test_scores = learning_curve(

estimator2, X, y, cv=cv, n_jobs=n_jobs, train_sizes=train_sizes)

train_scores_mean = np.mean(train_scores, axis=1)

train_scores_std = np.std(train_scores, axis=1)

test_scores_mean = np.mean(test_scores, axis=1)

test_scores_std = np.std(test_scores, axis=1)

ax2.fill_between(train_sizes, train_scores_mean - train_scores_std,

train_scores_mean + train_scores_std, alpha=0.1,

color="#ff9124")

ax2.fill_between(train_sizes, test_scores_mean - test_scores_std,

test_scores_mean + test_scores_std, alpha=0.1, color="#2492ff")

ax2.plot(train_sizes, train_scores_mean, 'o-', color="#ff9124",

label="Training score")

ax2.plot(train_sizes, test_scores_mean, 'o-', color="#2492ff",

label="Cross-validation score")

ax2.set_title("Knears Neighbors Learning Curve", fontsize=14)

ax2.set_xlabel('Training size (m)')

ax2.set_ylabel('Score')

ax2.grid(True)

ax2.legend(loc="best")

# Third Estimator

train_sizes, train_scores, test_scores = learning_curve(

estimator3, X, y, cv=cv, n_jobs=n_jobs, train_sizes=train_sizes)

train_scores_mean = np.mean(train_scores, axis=1)

train_scores_std = np.std(train_scores, axis=1)

test_scores_mean = np.mean(test_scores, axis=1)

test_scores_std = np.std(test_scores, axis=1)

ax3.fill_between(train_sizes, train_scores_mean - train_scores_std,

train_scores_mean + train_scores_std, alpha=0.1,

color="#ff9124")

ax3.fill_between(train_sizes, test_scores_mean - test_scores_std,

test_scores_mean + test_scores_std, alpha=0.1, color="#2492ff")

ax3.plot(train_sizes, train_scores_mean, 'o-', color="#ff9124",

label="Training score")

ax3.plot(train_sizes, test_scores_mean, 'o-', color="#2492ff",

label="Cross-validation score")

ax3.set_title("Support Vector Classifier \n Learning Curve", fontsize=14)

ax3.set_xlabel('Training size (m)')

ax3.set_ylabel('Score')

ax3.grid(True)

ax3.legend(loc="best")

# Fourth Estimator

train_sizes, train_scores, test_scores = learning_curve(

estimator4, X, y, cv=cv, n_jobs=n_jobs, train_sizes=train_sizes)

train_scores_mean = np.mean(train_scores, axis=1)

train_scores_std = np.std(train_scores, axis=1)

test_scores_mean = np.mean(test_scores, axis=1)

test_scores_std = np.std(test_scores, axis=1)

ax4.fill_between(train_sizes, train_scores_mean - train_scores_std,

train_scores_mean + train_scores_std, alpha=0.1,

color="#ff9124")

ax4.fill_between(train_sizes, test_scores_mean - test_scores_std,

test_scores_mean + test_scores_std, alpha=0.1, color="#2492ff")

ax4.plot(train_sizes, train_scores_mean, 'o-', color="#ff9124",

label="Training score")

ax4.plot(train_sizes, test_scores_mean, 'o-', color="#2492ff",

label="Cross-validation score")

ax4.set_title("Decision Tree Classifier \n Learning Curve", fontsize=14)

ax4.set_xlabel('Training size (m)')

ax4.set_ylabel('Score')

ax4.grid(True)

ax4.legend(loc="best")

return plt

cv = ShuffleSplit(n_splits=100, test_size=0.2, random_state=42)

plot_learning_curve(log_reg, knears_neighbors, svc, tree_clf, X_train, y_train, (0.87, 1.01), cv=cv, n_jobs=4)

<module 'matplotlib.pyplot' from '/opt/conda/lib/python3.6/site-packages/matplotlib/pyplot.py'>

from sklearn.metrics import roc_curve

from sklearn.model_selection import cross_val_predict

# Create a DataFrame with all the scores and the classifiers names.

log_reg_pred = cross_val_predict(log_reg, X_train, y_train, cv=5,

method="decision_function")

knears_pred = cross_val_predict(knears_neighbors, X_train, y_train, cv=5)

svc_pred = cross_val_predict(svc, X_train, y_train, cv=5,

method="decision_function")

tree_pred = cross_val_predict(tree_clf, X_train, y_train, cv=5)

from sklearn.metrics import roc_auc_score

print('Logistic Regression: ', roc_auc_score(y_train, log_reg_pred))

print('KNears Neighbors: ', roc_auc_score(y_train, knears_pred))

print('Support Vector Classifier: ', roc_auc_score(y_train, svc_pred))

print('Decision Tree Classifier: ', roc_auc_score(y_train, tree_pred))

Logistic Regression: 0.9798658657817729

KNears Neighbors: 0.9246195096680248

Support Vector Classifier: 0.9746783159014857

Decision Tree Classifier: 0.9173877431007686

log_fpr, log_tpr, log_thresold = roc_curve(y_train, log_reg_pred)

knear_fpr, knear_tpr, knear_threshold = roc_curve(y_train, knears_pred)

svc_fpr, svc_tpr, svc_threshold = roc_curve(y_train, svc_pred)

tree_fpr, tree_tpr, tree_threshold = roc_curve(y_train, tree_pred)

def graph_roc_curve_multiple(log_fpr, log_tpr, knear_fpr, knear_tpr, svc_fpr, svc_tpr, tree_fpr, tree_tpr):

plt.figure(figsize=(16,8))

plt.title('ROC Curve \n Top 4 Classifiers', fontsize=18)

plt.plot(log_fpr, log_tpr, label='Logistic Regression Classifier Score: {:.4f}'.format(roc_auc_score(y_train, log_reg_pred)))

plt.plot(knear_fpr, knear_tpr, label='KNears Neighbors Classifier Score: {:.4f}'.format(roc_auc_score(y_train, knears_pred)))

plt.plot(svc_fpr, svc_tpr, label='Support Vector Classifier Score: {:.4f}'.format(roc_auc_score(y_train, svc_pred)))

plt.plot(tree_fpr, tree_tpr, label='Decision Tree Classifier Score: {:.4f}'.format(roc_auc_score(y_train, tree_pred)))

plt.plot([0, 1], [0, 1], 'k--')

plt.axis([-0.01, 1, 0, 1])

plt.xlabel('False Positive Rate', fontsize=16)

plt.ylabel('True Positive Rate', fontsize=16)

plt.annotate('Minimum ROC Score of 50% \n (This is the minimum score to get)', xy=(0.5, 0.5), xytext=(0.6, 0.3),

arrowprops=dict(facecolor='#6E726D', shrink=0.05),

)

plt.legend()

graph_roc_curve_multiple(log_fpr, log_tpr, knear_fpr, knear_tpr, svc_fpr, svc_tpr, tree_fpr, tree_tpr)

plt.show()

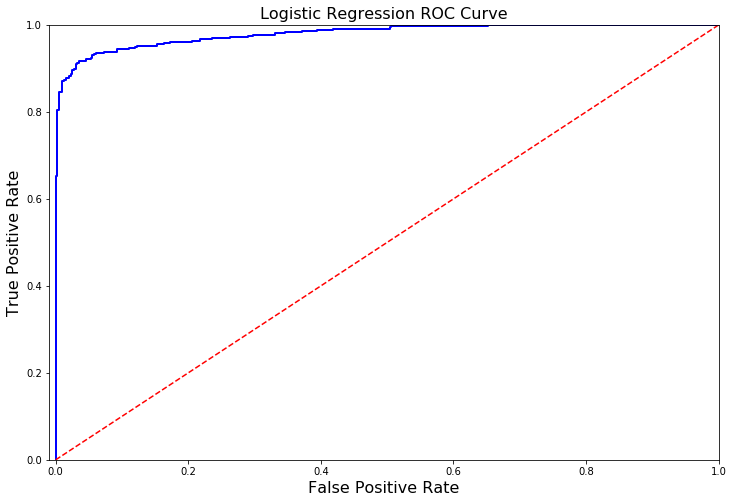

A Deeper Look into LogisticRegression:#

In this section we will ive a deeper look into the logistic regression classifier.

Terms:#

- True Positives: Correctly Classified Fraud Transactions

- False Positives: Incorrectly Classified Fraud Transactions

- True Negative: Correctly Classified Non-Fraud Transactions

- False Negative: Incorrectly Classified Non-Fraud Transactions

- Precision: True Positives/(True Positives + False Positives)

- Recall: True Positives/(True Positives + False Negatives)

- Precision as the name says, says how precise (how sure) is our model in detecting fraud transactions while recall is the amount of fraud cases our model is able to detect.

- Precision/Recall Tradeoff: The more precise (selective) our model is, the less cases it will detect. Example: Assuming that our model has a precision of 95%, Let's say there are only 5 fraud cases in which the model is 95% precise or more that these are fraud cases. Then let's say there are 5 more cases that our model considers 90% to be a fraud case, if we lower the precision there are more cases that our model will be able to detect.

Summary:#

- Precision starts to descend between 0.90 and 0.92 nevertheless, our precision score is still pretty high and still we have a descent recall score.

def logistic_roc_curve(log_fpr, log_tpr):

plt.figure(figsize=(12,8))

plt.title('Logistic Regression ROC Curve', fontsize=16)

plt.plot(log_fpr, log_tpr, 'b-', linewidth=2)

plt.plot([0, 1], [0, 1], 'r--')

plt.xlabel('False Positive Rate', fontsize=16)

plt.ylabel('True Positive Rate', fontsize=16)

plt.axis([-0.01,1,0,1])

logistic_roc_curve(log_fpr, log_tpr)

plt.show()

from sklearn.metrics import precision_recall_curve

precision, recall, threshold = precision_recall_curve(y_train, log_reg_pred)

from sklearn.metrics import recall_score, precision_score, f1_score, accuracy_score

y_pred = log_reg.predict(X_train)

# Overfitting Case

print('---' * 45)

print('Overfitting: \n')

print('Recall Score: {:.2f}'.format(recall_score(y_train, y_pred)))

print('Precision Score: {:.2f}'.format(precision_score(y_train, y_pred)))

print('F1 Score: {:.2f}'.format(f1_score(y_train, y_pred)))

print('Accuracy Score: {:.2f}'.format(accuracy_score(y_train, y_pred)))

print('---' * 45)

# How it should look like

print('---' * 45)

print('How it should be:\n')

print("Accuracy Score: {:.2f}".format(np.mean(undersample_accuracy)))

print("Precision Score: {:.2f}".format(np.mean(undersample_precision)))

print("Recall Score: {:.2f}".format(np.mean(undersample_recall)))

print("F1 Score: {:.2f}".format(np.mean(undersample_f1)))

print('---' * 45)

---------------------------------------------------------------------------------------------------------------------------------------

Overfitting:

Recall Score: 0.90

Precision Score: 0.76

F1 Score: 0.82

Accuracy Score: 0.81

---------------------------------------------------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------------------------------------------------

How it should be:

Accuracy Score: 0.65

Precision Score: 0.00

Recall Score: 0.29

F1 Score: 0.00

---------------------------------------------------------------------------------------------------------------------------------------

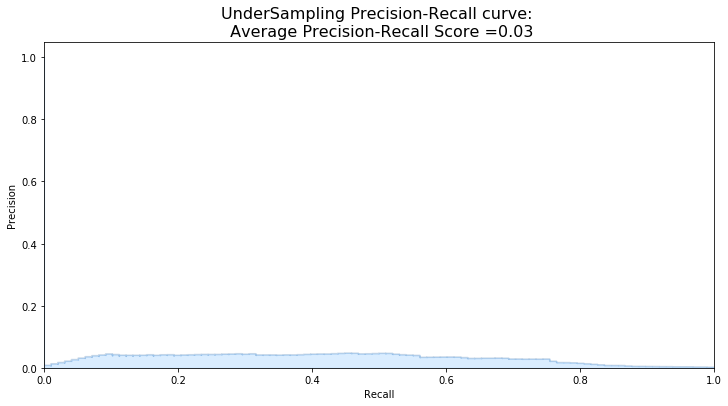

undersample_y_score = log_reg.decision_function(original_Xtest)

from sklearn.metrics import average_precision_score

undersample_average_precision = average_precision_score(original_ytest, undersample_y_score)

print('Average precision-recall score: {0:0.2f}'.format(

undersample_average_precision))

Average precision-recall score: 0.03

from sklearn.metrics import precision_recall_curve

import matplotlib.pyplot as plt

fig = plt.figure(figsize=(12,6))

precision, recall, _ = precision_recall_curve(original_ytest, undersample_y_score)

plt.step(recall, precision, color='#004a93', alpha=0.2,

where='post')

plt.fill_between(recall, precision, step='post', alpha=0.2,

color='#48a6ff')

plt.xlabel('Recall')

plt.ylabel('Precision')

plt.ylim([0.0, 1.05])

plt.xlim([0.0, 1.0])

plt.title('UnderSampling Precision-Recall curve: \n Average Precision-Recall Score ={0:0.2f}'.format(

undersample_average_precision), fontsize=16)

Text(0.5, 1.0, 'UnderSampling Precision-Recall curve: \n Average Precision-Recall Score =0.03')

SMOTE Technique (Over-Sampling):#

SMOTE stands for Synthetic Minority Over-sampling Technique. Unlike Random UnderSampling, SMOTE creates new synthetic points in order to have an equal balance of the classes. This is another alternative for solving the “class imbalance problems”.

Understanding SMOTE:

- Solving the Class Imbalance: SMOTE creates synthetic points from the minority class in order to reach an equal balance between the minority and majority class.

- Location of the synthetic points: SMOTE picks the distance between the closest neighbors of the minority class, in between these distances it creates synthetic points.

- Final Effect: More information is retained since we didn't have to delete any rows unlike in random undersampling.

- Accuracy || Time Tradeoff: Although it is likely that SMOTE will be more accurate than random under-sampling, it will take more time to train since no rows are eliminated as previously stated.

Overfitting during Cross Validation:#

In our undersample analysis I want to show you a common mistake I made that I want to share with all of you. It is simple, if you want to undersample or oversample your data you should not do it before cross validating. Why because you will be directly influencing the validation set before implementing cross-validation causing a “data leakage” problem.

As mentioned previously, if we get the minority class (“Fraud) in our case, and create the synthetic points before cross validating we have a certain influence on the “validation set” of the cross validation process. Remember how cross validation works, let’s assume we are splitting the data into 5 batches, 4/5 of the dataset will be the training set while 1/5 will be the validation set. The test set should not be touched! For that reason, we have to do the creation of synthetic datapoints “during” cross-validation and not before, just like below:

from imblearn.over_sampling import SMOTE

from sklearn.model_selection import train_test_split, RandomizedSearchCV

print('Length of X (train): {} | Length of y (train): {}'.format(len(original_Xtrain), len(original_ytrain)))

print('Length of X (test): {} | Length of y (test): {}'.format(len(original_Xtest), len(original_ytest)))

# List to append the score and then find the average

accuracy_lst = []

precision_lst = []

recall_lst = []

f1_lst = []

auc_lst = []

# Classifier with optimal parameters

# log_reg_sm = grid_log_reg.best_estimator_

log_reg_sm = LogisticRegression()

rand_log_reg = RandomizedSearchCV(LogisticRegression(), log_reg_params, n_iter=4)

# Implementing SMOTE Technique

# Cross Validating the right way

# Parameters

log_reg_params = {"penalty": ['l1', 'l2'], 'C': [0.001, 0.01, 0.1, 1, 10, 100, 1000]}

for train, test in sss.split(original_Xtrain, original_ytrain):

pipeline = imbalanced_make_pipeline(SMOTE(sampling_strategy='minority'), rand_log_reg) # SMOTE happens during Cross Validation not before..

model = pipeline.fit(original_Xtrain[train], original_ytrain[train])

best_est = rand_log_reg.best_estimator_

prediction = best_est.predict(original_Xtrain[test])

accuracy_lst.append(pipeline.score(original_Xtrain[test], original_ytrain[test]))

precision_lst.append(precision_score(original_ytrain[test], prediction))

recall_lst.append(recall_score(original_ytrain[test], prediction))

f1_lst.append(f1_score(original_ytrain[test], prediction))

auc_lst.append(roc_auc_score(original_ytrain[test], prediction))

print('---' * 45)

print('')

print("accuracy: {}".format(np.mean(accuracy_lst)))

print("precision: {}".format(np.mean(precision_lst)))

print("recall: {}".format(np.mean(recall_lst)))

print("f1: {}".format(np.mean(f1_lst)))

print('---' * 45)

Length of X (train): 227846 | Length of y (train): 227846

Length of X (test): 56961 | Length of y (test): 56961

---------------------------------------------------------------------------------------------------------------------------------------

accuracy: 0.9694005888966659

precision: 0.06547023328181797

recall: 0.9111002921129504

f1: 0.1209666729570652

---------------------------------------------------------------------------------------------------------------------------------------

labels = ['No Fraud', 'Fraud']

smote_prediction = best_est.predict(original_Xtest)

print(classification_report(original_ytest, smote_prediction, target_names=labels))

precision recall f1-score support

No Fraud 1.00 0.99 0.99 56863

Fraud 0.10 0.86 0.19 98

accuracy 0.99 56961

macro avg 0.55 0.92 0.59 56961

weighted avg 1.00 0.99 0.99 56961

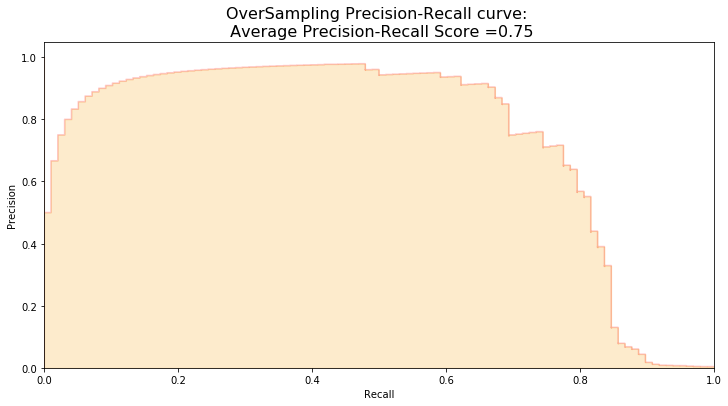

y_score = best_est.decision_function(original_Xtest)

average_precision = average_precision_score(original_ytest, y_score)

print('Average precision-recall score: {0:0.2f}'.format(

average_precision))

Average precision-recall score: 0.75

fig = plt.figure(figsize=(12,6))

precision, recall, _ = precision_recall_curve(original_ytest, y_score)

plt.step(recall, precision, color='r', alpha=0.2,

where='post')

plt.fill_between(recall, precision, step='post', alpha=0.2,

color='#F59B00')

plt.xlabel('Recall')

plt.ylabel('Precision')

plt.ylim([0.0, 1.05])

plt.xlim([0.0, 1.0])

plt.title('OverSampling Precision-Recall curve: \n Average Precision-Recall Score ={0:0.2f}'.format(

average_precision), fontsize=16)

Text(0.5, 1.0, 'OverSampling Precision-Recall curve: \n Average Precision-Recall Score =0.75')

# SMOTE Technique (OverSampling) After splitting and Cross Validating

sm = SMOTE(ratio='minority', random_state=42)

# Xsm_train, ysm_train = sm.fit_sample(X_train, y_train)

# This will be the data were we are going to

Xsm_train, ysm_train = sm.fit_sample(original_Xtrain, original_ytrain)

# We Improve the score by 2% points approximately

# Implement GridSearchCV and the other models.

# Logistic Regression

t0 = time.time()

log_reg_sm = grid_log_reg.best_estimator_

log_reg_sm.fit(Xsm_train, ysm_train)

t1 = time.time()

print("Fitting oversample data took :{} sec".format(t1 - t0))

Fitting oversample data took :14.371394634246826 sec

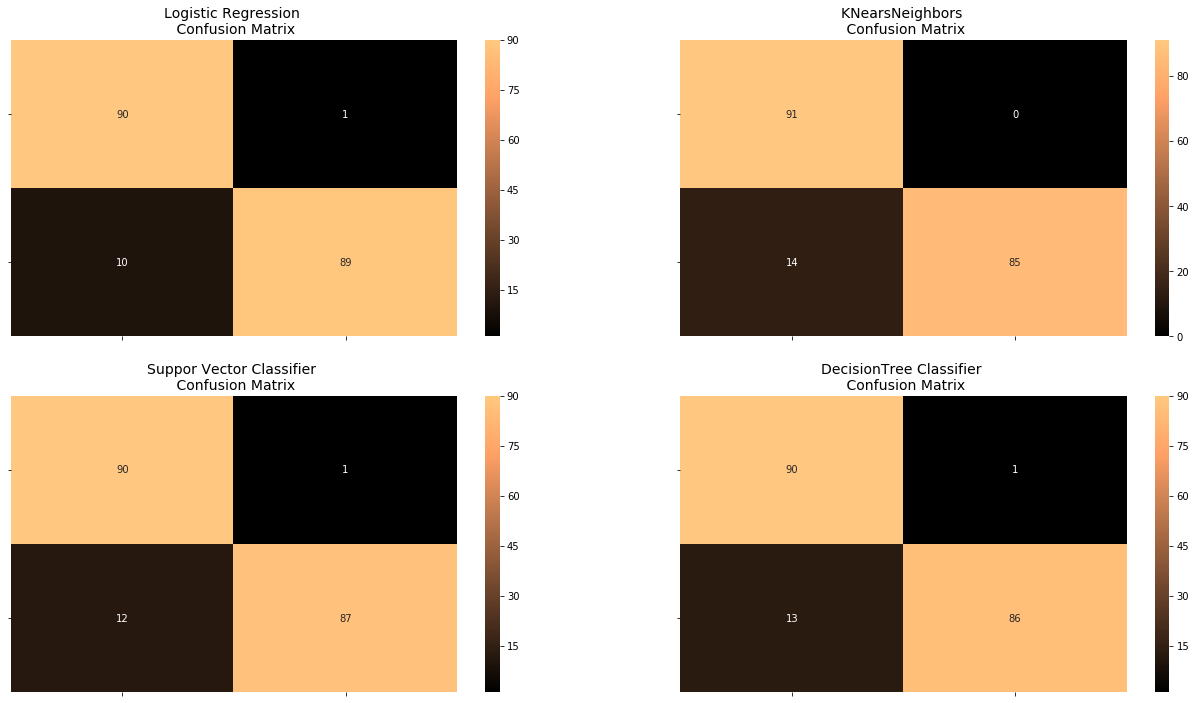

Test Data with Logistic Regression:#

Confusion Matrix:#

Positive/Negative: Type of Class (label) [“No”, “Yes”]

True/False: Correctly or Incorrectly classified by the model.

True Negatives (Top-Left Square): This is the number of correctly classifications of the “No” (No Fraud Detected) class.

False Negatives (Top-Right Square): This is the number of incorrectly classifications of the “No”(No Fraud Detected) class.

False Positives (Bottom-Left Square): This is the number of incorrectly classifications of the “Yes” (Fraud Detected) class

True Positives (Bottom-Right Square): This is the number of correctly classifications of the “Yes” (Fraud Detected) class.

Summary:#

- Random UnderSampling: We will evaluate the final performance of the classification models in the random undersampling subset. Keep in mind that this is not the data from the original dataframe.

- Classification Models: The models that performed the best were logistic regression and support vector classifier (SVM)

from sklearn.metrics import confusion_matrix

# Logistic Regression fitted using SMOTE technique

y_pred_log_reg = log_reg_sm.predict(X_test)

# Other models fitted with UnderSampling

y_pred_knear = knears_neighbors.predict(X_test)

y_pred_svc = svc.predict(X_test)

y_pred_tree = tree_clf.predict(X_test)

log_reg_cf = confusion_matrix(y_test, y_pred_log_reg)

kneighbors_cf = confusion_matrix(y_test, y_pred_knear)

svc_cf = confusion_matrix(y_test, y_pred_svc)

tree_cf = confusion_matrix(y_test, y_pred_tree)

fig, ax = plt.subplots(2, 2,figsize=(22,12))

sns.heatmap(log_reg_cf, ax=ax[0][0], annot=True, cmap=plt.cm.copper)

ax[0, 0].set_title("Logistic Regression \n Confusion Matrix", fontsize=14)

ax[0, 0].set_xticklabels(['', ''], fontsize=14, rotation=90)

ax[0, 0].set_yticklabels(['', ''], fontsize=14, rotation=360)

sns.heatmap(kneighbors_cf, ax=ax[0][1], annot=True, cmap=plt.cm.copper)

ax[0][1].set_title("KNearsNeighbors \n Confusion Matrix", fontsize=14)

ax[0][1].set_xticklabels(['', ''], fontsize=14, rotation=90)

ax[0][1].set_yticklabels(['', ''], fontsize=14, rotation=360)

sns.heatmap(svc_cf, ax=ax[1][0], annot=True, cmap=plt.cm.copper)

ax[1][0].set_title("Suppor Vector Classifier \n Confusion Matrix", fontsize=14)

ax[1][0].set_xticklabels(['', ''], fontsize=14, rotation=90)

ax[1][0].set_yticklabels(['', ''], fontsize=14, rotation=360)

sns.heatmap(tree_cf, ax=ax[1][1], annot=True, cmap=plt.cm.copper)

ax[1][1].set_title("DecisionTree Classifier \n Confusion Matrix", fontsize=14)

ax[1][1].set_xticklabels(['', ''], fontsize=14, rotation=90)

ax[1][1].set_yticklabels(['', ''], fontsize=14, rotation=360)

plt.show()

from sklearn.metrics import classification_report

print('Logistic Regression:')

print(classification_report(y_test, y_pred_log_reg))

print('KNears Neighbors:')

print(classification_report(y_test, y_pred_knear))

print('Support Vector Classifier:')

print(classification_report(y_test, y_pred_svc))

print('Support Vector Classifier:')

print(classification_report(y_test, y_pred_tree))

Logistic Regression:

precision recall f1-score support

0 0.90 0.99 0.94 91

1 0.99 0.90 0.94 99

accuracy 0.94 190

macro avg 0.94 0.94 0.94 190

weighted avg 0.95 0.94 0.94 190

KNears Neighbors:

precision recall f1-score support

0 0.87 1.00 0.93 91

1 1.00 0.86 0.92 99

accuracy 0.93 190

macro avg 0.93 0.93 0.93 190

weighted avg 0.94 0.93 0.93 190

Support Vector Classifier:

precision recall f1-score support

0 0.88 0.99 0.93 91

1 0.99 0.88 0.93 99

accuracy 0.93 190

macro avg 0.94 0.93 0.93 190

weighted avg 0.94 0.93 0.93 190

Support Vector Classifier:

precision recall f1-score support

0 0.87 0.99 0.93 91

1 0.99 0.87 0.92 99

accuracy 0.93 190

macro avg 0.93 0.93 0.93 190

weighted avg 0.93 0.93 0.93 190

# Final Score in the test set of logistic regression

from sklearn.metrics import accuracy_score

# Logistic Regression with Under-Sampling

y_pred = log_reg.predict(X_test)

undersample_score = accuracy_score(y_test, y_pred)

# Logistic Regression with SMOTE Technique (Better accuracy with SMOTE t)

y_pred_sm = best_est.predict(original_Xtest)

oversample_score = accuracy_score(original_ytest, y_pred_sm)

d = {'Technique': ['Random UnderSampling', 'Oversampling (SMOTE)'], 'Score': [undersample_score, oversample_score]}

final_df = pd.DataFrame(data=d)

# Move column

score = final_df['Score']

final_df.drop('Score', axis=1, inplace=True)

final_df.insert(1, 'Score', score)

# Note how high is accuracy score it can be misleading!

final_df

| Technique | Score | |

|---|---|---|

| 0 | Random UnderSampling | 0.942105 |

| 1 | Oversampling (SMOTE) | 0.987079 |

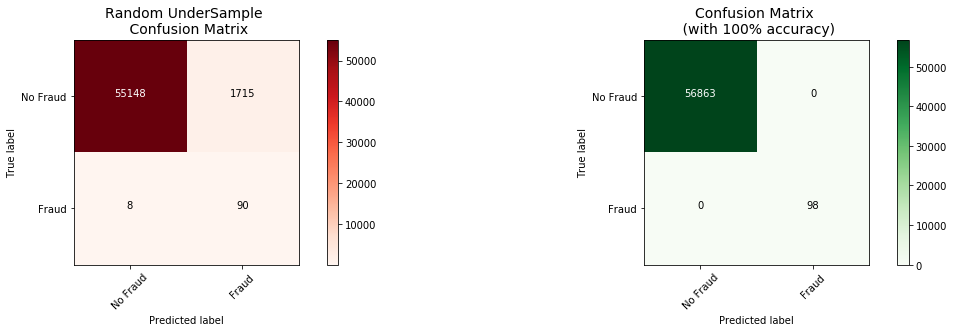

Neural Networks Testing Random UnderSampling Data vs OverSampling (SMOTE):#

In this section we will implement a simple Neural Network (with one hidden layer) in order to see which of the two logistic regressions models we implemented in the (undersample or oversample(SMOTE)) has a better accuracy for detecting fraud and non-fraud transactions.

Our Main Goal:#

Our main goal is to explore how our simple neural network behaves in both the random undersample and oversample dataframes and see whether they can predict accuractely both non-fraud and fraud cases. Why not only focus on fraud? Imagine you were a cardholder and after you purchased an item your card gets blocked because the bank’s algorithm thought your purchase was a fraud. That’s why we shouldn’t emphasize only in detecting fraud cases but we should also emphasize correctly categorizing non-fraud transactions.

The Confusion Matrix:#

Here is again, how the confusion matrix works:

- Upper Left Square: The amount of correctly classified by our model of no fraud transactions.

- Upper Right Square: The amount of incorrectly classified transactions as fraud cases, but the actual label is no fraud .

- Lower Left Square: The amount of incorrectly classified transactions as no fraud cases, but the actual label is fraud .

- Lower Right Square: The amount of correctly classified by our model of fraud transactions.

Summary (Keras || Random UnderSampling):#

- Dataset: In this final phase of testing we will fit this model in both the random undersampled subset and oversampled dataset (SMOTE) in order to predict the final result using the original dataframe testing data.

- Neural Network Structure: As stated previously, this will be a simple model composed of one input layer (where the number of nodes equals the number of features) plus bias node, one hidden layer with 32 nodes and one output node composed of two possible results 0 or 1 (No fraud or fraud).

- Other characteristics: The learning rate will be 0.001, the optimizer we will use is the AdamOptimizer, the activation function that is used in this scenario is "Relu" and for the final outputs we will use sparse categorical cross entropy, which gives the probability whether an instance case is no fraud or fraud (The prediction will pick the highest probability between the two.)

import keras

from keras import backend as K

from keras.models import Sequential

from keras.layers import Activation

from keras.layers.core import Dense

from keras.optimizers import Adam

from keras.metrics import categorical_crossentropy

n_inputs = X_train.shape[1]

undersample_model = Sequential([

Dense(n_inputs, input_shape=(n_inputs, ), activation='relu'),

Dense(32, activation='relu'),

Dense(2, activation='softmax')

])

Using TensorFlow backend.

undersample_model.summary()

_________________________________________________________________

Layer (type) Output Shape Param #

=================================================================

dense_1 (Dense) (None, 30) 930

_________________________________________________________________

dense_2 (Dense) (None, 32) 992

_________________________________________________________________

dense_3 (Dense) (None, 2) 66

=================================================================

Total params: 1,988

Trainable params: 1,988

Non-trainable params: 0

_________________________________________________________________

undersample_model.compile(Adam(lr=0.001), loss='sparse_categorical_crossentropy', metrics=['accuracy'])

undersample_model.fit(X_train, y_train, validation_split=0.2, batch_size=25, epochs=20, shuffle=True, verbose=2)

Train on 605 samples, validate on 152 samples

Epoch 1/20

- 0s - loss: 0.4640 - acc: 0.7455 - val_loss: 0.3672 - val_acc: 0.8684

Epoch 2/20

- 0s - loss: 0.3475 - acc: 0.8579 - val_loss: 0.2970 - val_acc: 0.9342

Epoch 3/20

- 0s - loss: 0.2830 - acc: 0.9107 - val_loss: 0.2592 - val_acc: 0.9342

Epoch 4/20

- 0s - loss: 0.2364 - acc: 0.9388 - val_loss: 0.2336 - val_acc: 0.9211

Epoch 5/20

- 0s - loss: 0.2038 - acc: 0.9421 - val_loss: 0.2161 - val_acc: 0.9211

Epoch 6/20

- 0s - loss: 0.1798 - acc: 0.9488 - val_loss: 0.1980 - val_acc: 0.9211

Epoch 7/20

- 0s - loss: 0.1621 - acc: 0.9504 - val_loss: 0.1890 - val_acc: 0.9276

Epoch 8/20

- 0s - loss: 0.1470 - acc: 0.9521 - val_loss: 0.1864 - val_acc: 0.9276

Epoch 9/20

- 0s - loss: 0.1367 - acc: 0.9554 - val_loss: 0.1838 - val_acc: 0.9276

Epoch 10/20

- 0s - loss: 0.1281 - acc: 0.9603 - val_loss: 0.1826 - val_acc: 0.9211

Epoch 11/20

- 0s - loss: 0.1218 - acc: 0.9537 - val_loss: 0.1795 - val_acc: 0.9211

Epoch 12/20

- 0s - loss: 0.1134 - acc: 0.9570 - val_loss: 0.1856 - val_acc: 0.9211

Epoch 13/20

- 0s - loss: 0.1071 - acc: 0.9587 - val_loss: 0.1852 - val_acc: 0.9276

Epoch 14/20

- 0s - loss: 0.1015 - acc: 0.9620 - val_loss: 0.1790 - val_acc: 0.9211

Epoch 15/20

- 0s - loss: 0.0966 - acc: 0.9587 - val_loss: 0.1842 - val_acc: 0.9276

Epoch 16/20

- 0s - loss: 0.0910 - acc: 0.9636 - val_loss: 0.1813 - val_acc: 0.9276

Epoch 17/20

- 0s - loss: 0.0871 - acc: 0.9620 - val_loss: 0.1831 - val_acc: 0.9276

Epoch 18/20

- 0s - loss: 0.0835 - acc: 0.9636 - val_loss: 0.1822 - val_acc: 0.9276

Epoch 19/20

- 0s - loss: 0.0791 - acc: 0.9702 - val_loss: 0.1822 - val_acc: 0.9276

Epoch 20/20

- 0s - loss: 0.0751 - acc: 0.9752 - val_loss: 0.1877 - val_acc: 0.9211

<keras.callbacks.History at 0x7f056fd8e278>

undersample_predictions = undersample_model.predict(original_Xtest, batch_size=200, verbose=0)

undersample_fraud_predictions = undersample_model.predict_classes(original_Xtest, batch_size=200, verbose=0)

import itertools

# Create a confusion matrix

def plot_confusion_matrix(cm, classes,

normalize=False,

title='Confusion matrix',

cmap=plt.cm.Blues):

"""

This function prints and plots the confusion matrix.

Normalization can be applied by setting `normalize=True`.

"""

if normalize:

cm = cm.astype('float') / cm.sum(axis=1)[:, np.newaxis]

print("Normalized confusion matrix")

else:

print('Confusion matrix, without normalization')

print(cm)

plt.imshow(cm, interpolation='nearest', cmap=cmap)

plt.title(title, fontsize=14)

plt.colorbar()

tick_marks = np.arange(len(classes))

plt.xticks(tick_marks, classes, rotation=45)

plt.yticks(tick_marks, classes)

fmt = '.2f' if normalize else 'd'

thresh = cm.max() / 2.

for i, j in itertools.product(range(cm.shape[0]), range(cm.shape[1])):

plt.text(j, i, format(cm[i, j], fmt),

horizontalalignment="center",

color="white" if cm[i, j] > thresh else "black")

plt.tight_layout()

plt.ylabel('True label')

plt.xlabel('Predicted label')

undersample_cm = confusion_matrix(original_ytest, undersample_fraud_predictions)

actual_cm = confusion_matrix(original_ytest, original_ytest)

labels = ['No Fraud', 'Fraud']

fig = plt.figure(figsize=(16,8))

fig.add_subplot(221)

plot_confusion_matrix(undersample_cm, labels, title="Random UnderSample \n Confusion Matrix", cmap=plt.cm.Reds)

fig.add_subplot(222)

plot_confusion_matrix(actual_cm, labels, title="Confusion Matrix \n (with 100% accuracy)", cmap=plt.cm.Greens)

Confusion matrix, without normalization

[[55148 1715]

[ 8 90]]

Confusion matrix, without normalization

[[56863 0]

[ 0 98]]

Keras || OverSampling (SMOTE):#